Spread Trading: A Simple Guide to Understanding this Strategy

Trading is a complex and diverse world with many different strategies and approaches. Among these strategies, one of the most intriguing and often less well-known is spread trading. In this article, we will guide you through the basic concepts of spread trading in a simple and understandable way.

What is Spread Trading?

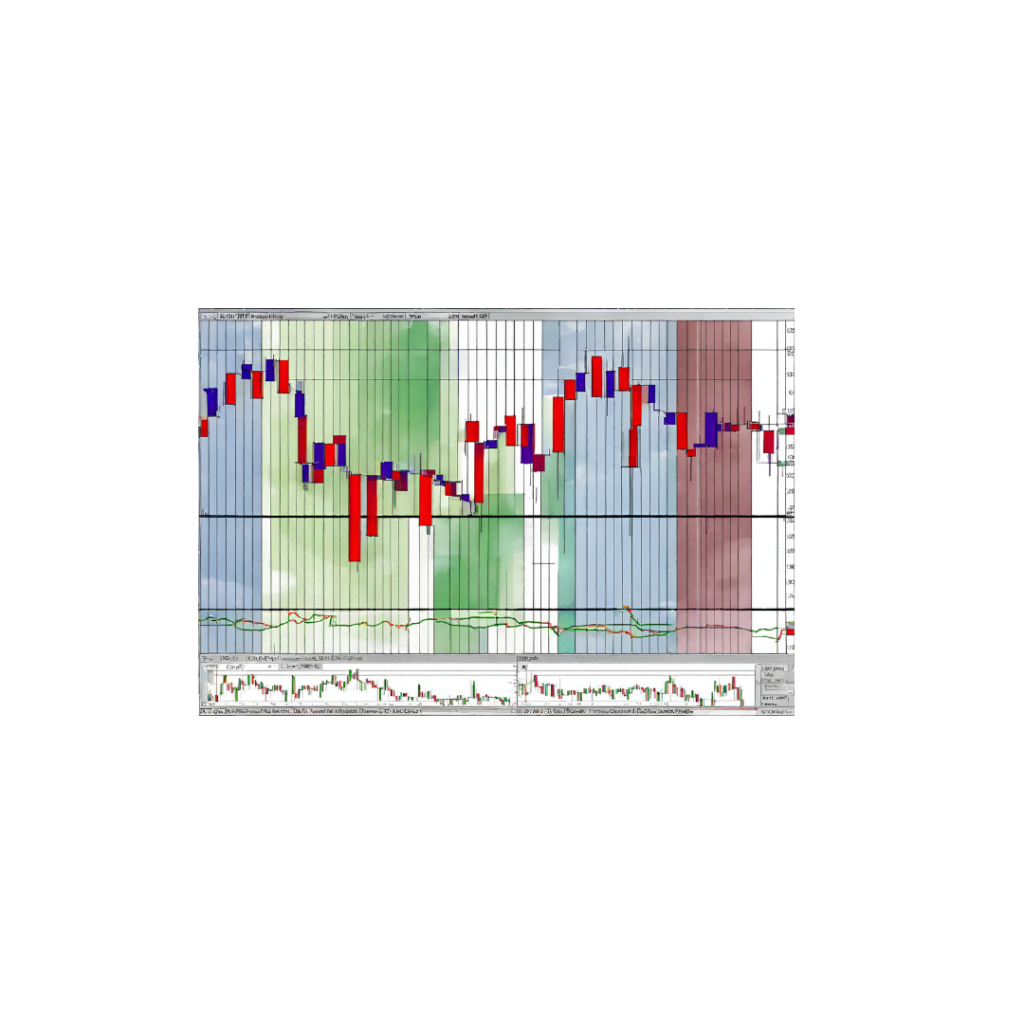

Spread trading is a strategy that involves the simultaneous buying and selling of two related financial instruments. The primary goal is to capitalize on changes in the relative prices of the two instruments rather than betting directly on the market’s direction.

Imagine having two financial instruments, such as two different company stocks or two stock index futures. In spread trading, you would buy one contract of one of them and sell one contract of the other at the same time. This strategy is based on the belief that the relationship between the two instruments will move in a certain direction.

A Simple Example

To make this strategy clearer, let’s consider a concrete example:

Suppose you are observing two automobile companies, A and B. You notice that over time, the price of A’s stocks tends to rise when the price of B’s stocks falls, and vice versa. This is a good example of a negative correlation between two financial instruments.

In traditional trading, you might decide to buy shares of A if you think they will increase in value. However, with spread trading, you would take a different approach. You would buy one contract of A’s stocks and, simultaneously, sell one contract of B’s stocks. This way, your profit would depend on the price difference between the two stocks.

If A’s stocks increase in value while B’s stocks decrease in price, you’ll profit from the difference in those price movements. Furthermore, this strategy reduces overall risk because you are long on one stock and short on the other.

Risk Management

In the world of trading, risk management is essential, and spread trading is no exception. You can set stop-loss orders to protect your capital and take-profit orders to lock in your desired gains.

It’s also important to keep an eye on the correlation between the two instruments you are trading. A negative correlation, as in our example, implies that the two instruments tend to move in opposite directions. But correlations can change over time, so ongoing monitoring is crucial.

Conclusion

Spread trading is an advanced trading strategy, but it can be approached relatively simply if you understand the basic concepts. Instead of betting on the market’s direction, you’re betting on the price difference between two related instruments. This strategy can reduce overall risk and offer profit opportunities even in volatile markets. However, it’s essential to study and thoroughly understand the markets and the correlations between the instruments before starting to engage in spread trading.